Deferred Gift Annuities

Younger than 65? Consider a Deferred Annuity

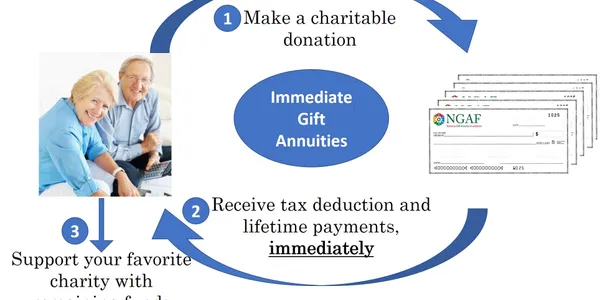

As a younger donor, still in high-earnings, you are still saving for retirement and also trying to lower your taxable income. Here’s how it works:

- TRANSFER cash or securities to the National Gift Annuity Foundation. Our minimum gift requirement is $20,000.

- RECEIVE an immediate charitable income tax deduction and potential savings in capital gains and estate tax.

- COLLECT life-time fixed payments for 1) you, 2) you and your spouse, or 3) any two beneficiaries you name. Note: beneficiaries must be at least 55 years old.

- SUPPORT your recommended charity(ies) with the final residuum balance via NGAF.

Features & Benefits

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction.

- You can schedule your annuity payments to begin when you need extra income, such as retirement years.

- Payments are guaranteed and fixed, regardless of fluctuations in the market.

- The longer you elect to defer payments, the higher your payment will be.